Here’s the topic of the day: Do your kids get allowance? Do they have to earn it? Money is on everyone’s mind these days and it was a spirited topic during a recent Thursday evening Tweet Chat that I host, called #DadChat**. Tweet Chats are growing as different communities band together for an hour or so and chat with each other using a name and hashtag (the # symbol).

Here’s the topic of the day: Do your kids get allowance? Do they have to earn it? Money is on everyone’s mind these days and it was a spirited topic during a recent Thursday evening Tweet Chat that I host, called #DadChat**. Tweet Chats are growing as different communities band together for an hour or so and chat with each other using a name and hashtag (the # symbol).

In a recent #DadChat, the topic of money and our kids was discussed and Chuck Flagg shared the method his family dealt with allowance. We decided to co-write this column and share our respective opinions and experiences with this delicate subject. I met Chuck via my #DadChat and, like so many virtual friends, we’ve never actually met or even spoken, but we do know one another well. Chuck, the floor is yours:

The silence around the house is deafening. It is that time of the year when my daughter has returned to school. It is also that time of the year when my daughter gets her allowance raised. So with apologies to Mick and the boys…”please Allowance me to introduce myself.” I am a stay-at-home dad of an eight-year-old girl. I am also a business owner of a travel consultant agency specializing in cruises and all-inclusive vacations. I also write a blog with various tips, news and information to inform the novice and experienced cruiser.

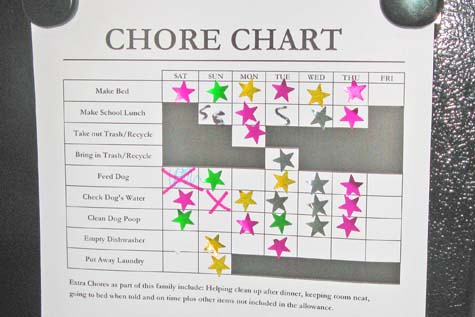

For her allowance, my wife and I follow a version of Clark Howard’s plan from his book, “Clark Smart Parents, Clark Smart Kids.” We give her $1 per week per grade level. As a third grader, she is now earning $3 a week. My wife and I believe the best way for our daughter to learn about money and finance is to earn her “allowance.” Year after year, we increase her responsibilities as we increase her allowance. For the first time this year, we have a dedicated chore chart highly visible on our fridge.

She has a set of terms to follow with regard to her “chore chart.” If she does a task on her own, or takes the initiative to ask me for help, she earns a sticker. If I have to remind her to do a particular chore and she does that chore, she receives no sticker. If she is reminded but runs out of time or chooses to do something else before bedtime, I do the chore and she gets a red “X” on her chart. For every “X” she gets $.25 deducted from her weekly allowance. She has other opportunities to earn money from mowing the lawn to raking leaves, and washing my car. I figure that I’d rather my daughter have the opportunity to earn this money than pay a stranger.

We encourage our daughter to save because we double any cash she has not spent (including money for birthdays, from grandparents, etc.) twice a year. On her birthday and Christmas, we count the money in her piggy bank and double that cash. We then take that cash and put it in an UGMA account and she starts again with a starter base of $50. You can argue all you want about the tax disadvantages of an UGMA savings account (Uniform Gift to Minors Act) versus a 529, but we have our own reasons for doing her savings this way.

This year she wants an iPad and already has one picked out. Instead of doubling her money this year, I have offered her the “Daddy-Match.” If she can save up to half of it, we will pay the other half. When she gets older, she will have other ways she can earn money whether it is pet-sitting, dog-walking, or mail-collection for people out of town. We have also told her the real money will come when she starts babysitting.

Thank You, Chuck. I largely love their system though I disagree about an UGMA account for the simple reason that these accounts are accessible to our children, unconditionally, at 18, I believe. I want to monitor any money we put aside for our children until/if I know they’re ready to take over themselves. Since the teen brain is far from mature, I’d rather keep this control.

Regarding the rest of Chuck’s plan, we are on the same page. Giving anyone anything for nothing is giving him or her nothing of value. Teach someone to fish rather than give them fish. Teach self-sufficiency. The sooner we teach our kids the real value of money, the better.

I began teaching my boys about savings when they were still single-digit ages. They both loved to read and I gave them a weekly book allowance. It was enough to purchase an inexpensive book each week, but not enough for those bigger, picture books they really wanted. So, unless they learned to wait, they’d only get those cheaper books. My older son, by virtue of being three years older, was willing to wait for the more expensive books. My younger son bought something each week…until. Until he saw this gorgeous, big picture book his older brother bought after saving for four weeks. Lesson learned.

As with Chuck’s household, the boys who are both teens now, have to do certain chores to earn their allowance. Our system is different, but the principles are the same. Making our kids responsible, teaching them these lessons, taking the time to figure this out, and being on the same page with your spouse, is part of our job as parent. Do it.

Enjoy this week’s “A Dad’s Point-of-View” Comic Strip called, “Allowance”

**To learn more about #DadChat, visit this article that explains how it works and gives all the necessary information to participate.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Get Bruce’s new book and Limited Edition (of 500 ) Poster, A Dad’s Point-of-View: We ARE Half the Equation at Amazon, iTunes, BN.com, or The Store here on our web site.

) Poster, A Dad’s Point-of-View: We ARE Half the Equation at Amazon, iTunes, BN.com, or The Store here on our web site.