I suppose the title of this column got your attention. Of course I don’t mean it in any literal sense but I’ve begun a mantra/rant lately that includes this notion. My older son just got accepted to an expensive private college, The Berklee College of Music. For a number of reasons, he/we do not qualify for any financial aid. Upon consulting with my friend Jodi Okun of College Financial Aid Advisors, who helps families with these issues for a living, I learned the reasons we did not qualify for financial aid.

Before I illuminate those reasons, I have to declare that my son did himself and his family no good – as far as getting any scholarships – because of his lousy grades and failure to even take the SAT or other college entrance exams. His outstanding musicianship and showmanship at the audition, required by Berklee, clearly overcame any deficiencies from his transcripts and lack of college entrance exams. He shines when he does his music and he worked quite hard preparing for that audition. It paid off when he was one of less than 200 applicants accepted for early admission – to the only college to which he applied.

When we visited Berklee for his audition, we were informed on our parent/applicant tour that any acceptance would be accompanied by whatever aid/scholarship help the accepted student was eligible for. When that wonderful “You’re In” letter arrived, it didn’t have a mention of aid or scholarship on it. It wasn’t an oversight, as Jodi patiently and, to some degree, laughingly explained to me.

See, I was just too darn responsible. I’d done things that just didn’t help the family cause when it comes to qualifying for financial aid. My younger son is academic so he may succeed in getting some sort of scholarship. I’m trying to incentivize him to do so with various promised bribes. If I’d done some or all of the items on the following list, my son (and his younger brother who wants to go to NYU and will likely get in) might have qualified for financial aid:

1. Abandoned my boys when their mother and I got divorced.

2. Gotten in terrible debt.

3. Not paid my mortgage, credit cards bills, or rent (we rented shortly after my divorce, for 4 years).

4. Spent every penny I ever earned.

5. Became any sort of addict, especially gambling where I could have lost everything we had.

6. Gotten caught and arrested after committing a serious crime that got me new housing – in jail.

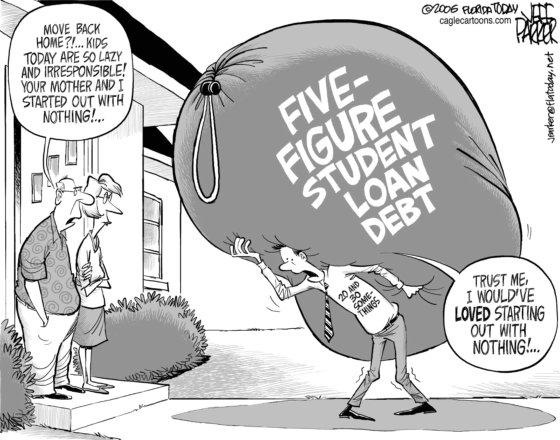

What was I thinking? Now, I have to scrimp, save, and sacrifice to send my son to the college of his choice. Thankfully, I did save a certain amount for my sons’ college education from the moment they were born. But, the cost of college has risen far beyond any predictions we carefully made 19 years ago. I put away more than enough if they chose to go to community college for two years and then transfer to a state college or university. For that matter, I saved enough for Berklee and NYU based on the projections available for their tuition two decades ago!

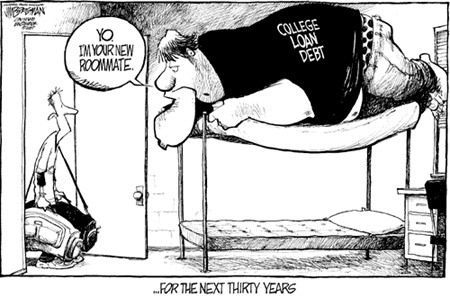

In short, I did everything right and consequently got treated all wrong. Yes, private loans are available – at wise-guy interest rates. Jodi asked me a few simple questions about my finances. When I answered that I actually had some equity in the house we bought a couple of years ago and that I had retirement accounts that still held some value, Jodi said we were out of luck.

Aside from my irritation at this ironic fact, I was concerned that if I gave my son a so-called “free ride,” I’d not be doing him any service. I asked Jodi why I couldn’t self-finance a loan to my son for part of his college education. We decided that my son should be responsible for one year of his education. Jodi prepared a loan document, replete with an amortization schedule, and we set it up exactly the same as if he’d received formal financial aid.

His loan is interest-free until six months after he graduates. It then accrues interest at the rate for government financial aid. He then begins a payment schedule that shows him exactly how much he’s reducing this debt in the same way mortgage holders see their loan amount reduced each month by regular payments. Of course, I have no collateral other than his word and signature on the loan document, but I feel it gives him a stake in his education that I hope will keep him mostly centered on completing it.

When did things go so wrong in our country that being responsible seems to equate with being punished? That is how I feel. Yes, I can afford to pay these exorbitant costs for my boy’s college education but it will most definitely hurt our lifestyle to a considerable degree. Their mom is not a factor and the huge amount of money she got from our divorce is evidently long lost, so looking to her to help is not an option.

On the other hand, my second wife – who is my boy’s step-mom – has to suffer our downsizing of lifestyle. She has accepted this fact with incredible grace given how she’s come to love the boys so much. I just can’t help but feel there is something seriously wrong with this scenario!